nj property tax relief for veterans

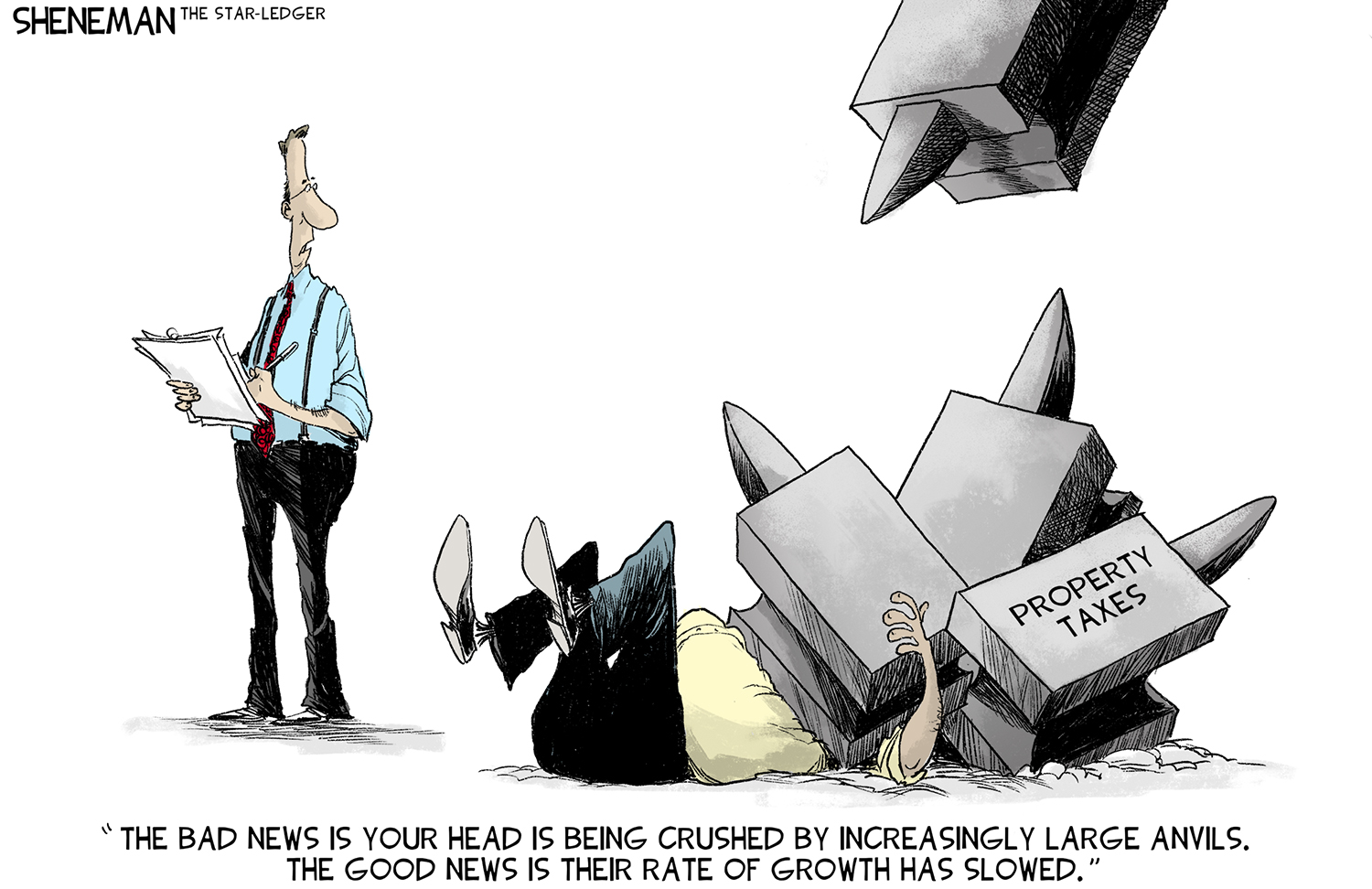

It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. About the Company Property Tax Relief For Veterans In Nj.

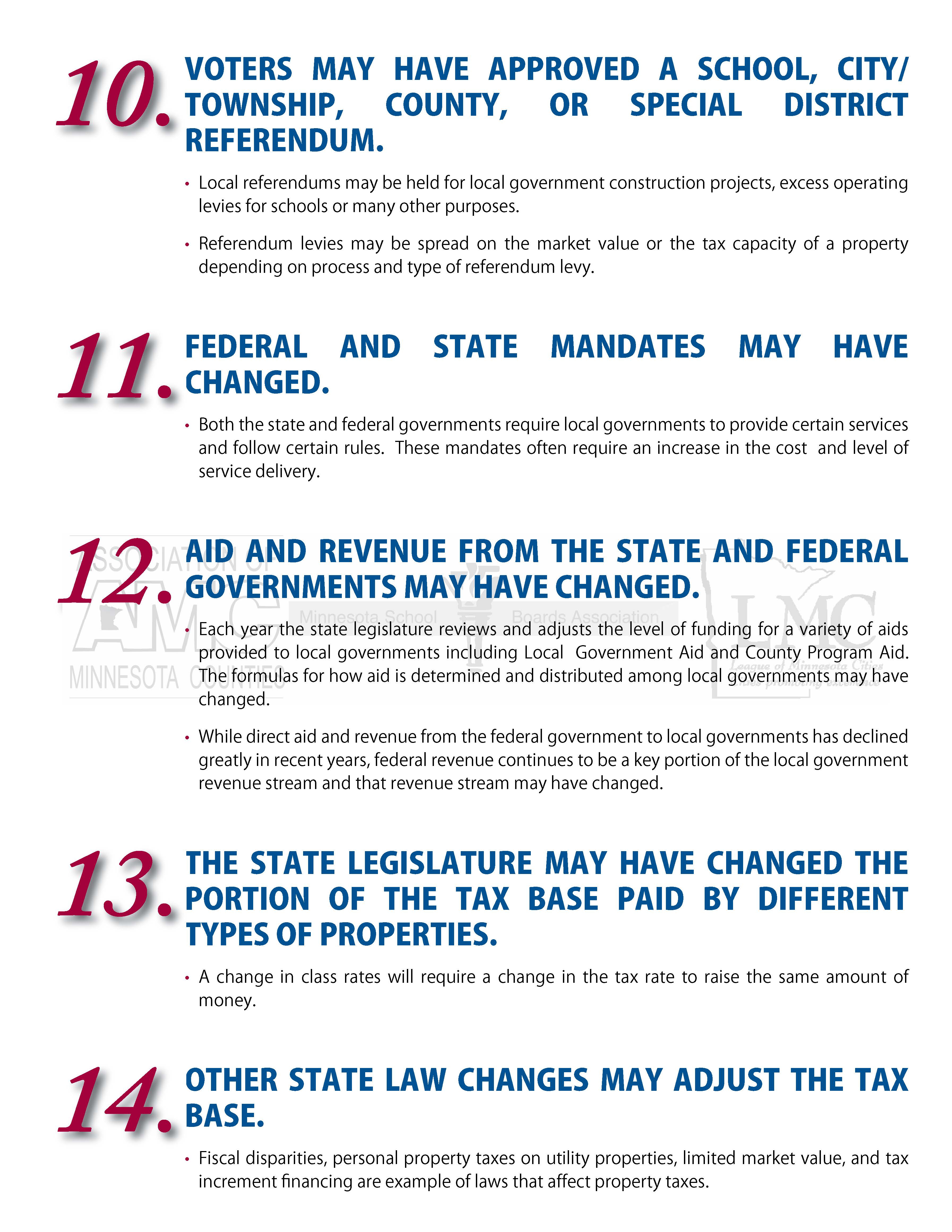

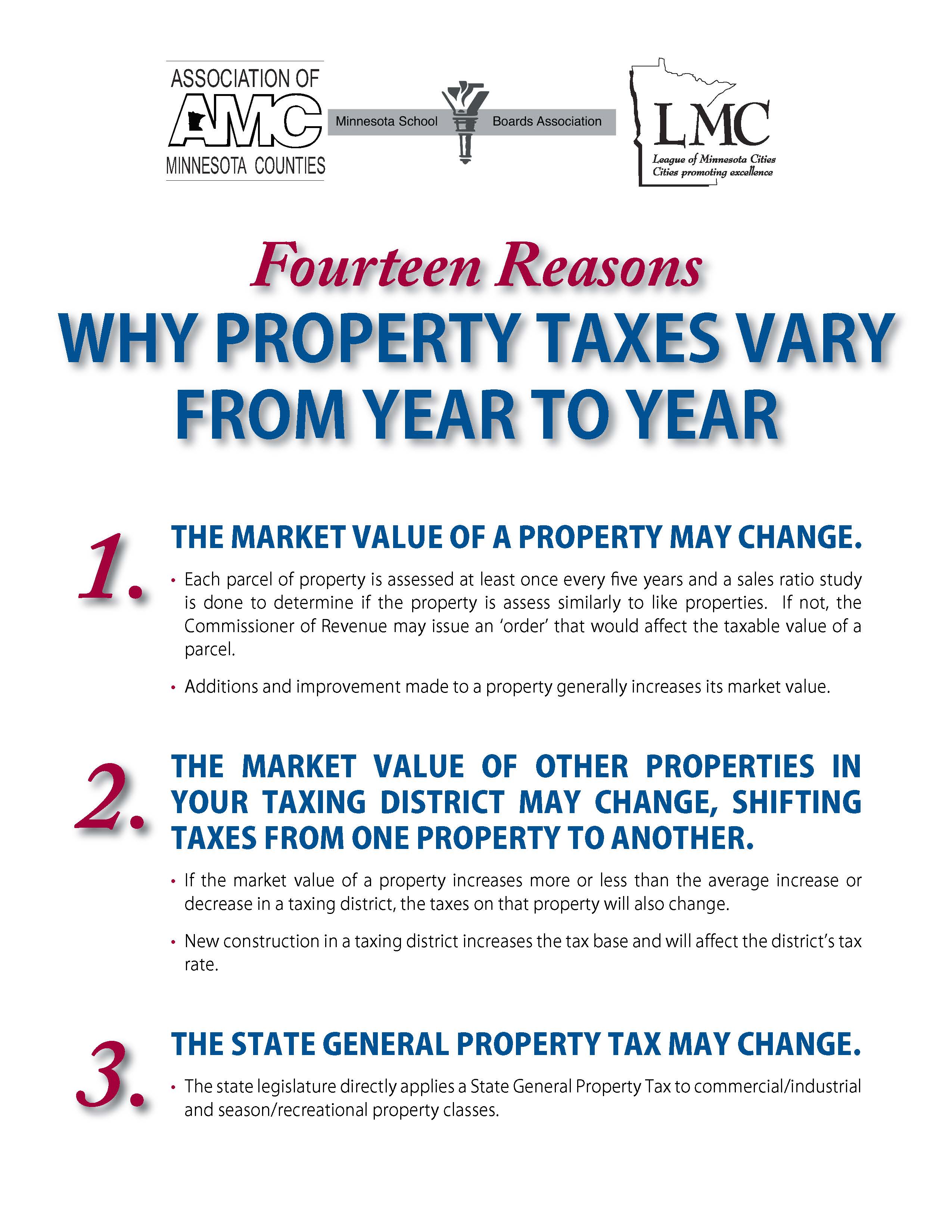

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

For Tax Year 2021 and after combat pay is not taxable in New Jersey PL.

. The State of New Jersey offers tax relief in various forms to certain property owners. New Jersey Extends 2021 Tax-Filing Deadline for Kentucky Tornado Victims. The Homestead Benefit program provides property tax relief to eligible homeowners.

Ad Search For Info About Nj property tax relief. TRENTON The Department of the Treasury testified before the Senate Budget and Appropriations Committee at the State House today providing a detailed update on revenue projections for the remainder of Fiscal Year 2022 FY 2022 through Fiscal Year 2023. Property Tax Deductions Senior Citizens Veterans and Surviving Spouses If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions.

A disabled veteran in Vermont may receive a property tax exemption of at least 10000 on hisher primary residence if the veteran is 50 percent or more disabled as a result of service. The 100 property tax exemption for disabled veterans is only applicable to taxes paid on a primary residence. Primary residence completely exempted from taxes.

Applications for the homeowner benefit are not available on this site for printing. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. Veterans must own their homes to qualify.

Veterans who own less than 5000 worth of property or 10000 worth for a married couple or surviving spouse 4000 exemption for real or personal property. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax. NJ Tax Relief for Hurricane Ida Victims.

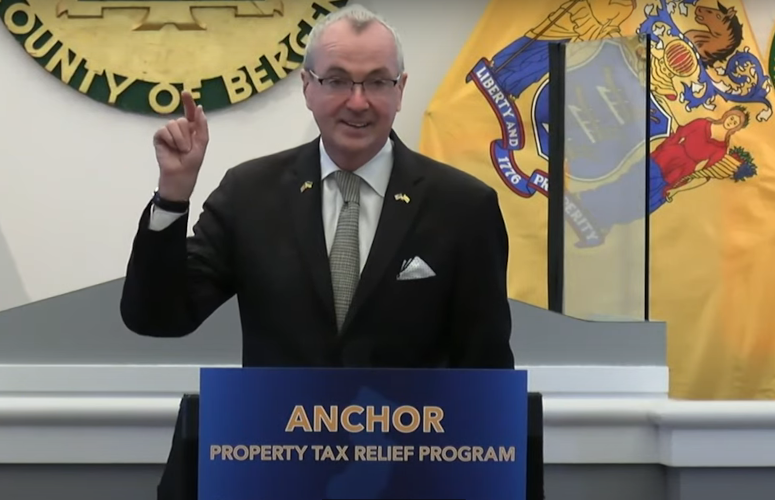

Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. The 100 property tax exemption for disabled veterans is applicable only to taxes paid on a primary residence. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care retirement community CCRC.

Senior or Disabled Tax Deduction Application PDF Veteran Tax Deduction Application PDF Forms. 100 permanently disabled loss of one or more limbs or total blindness in one or both eyes. The most common programs are as follows.

The 2021 property tax credits are based on ones 2017 income and property taxes paid. At least 14 days in a combat zone are eligible for an annual 250 property. Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior.

Property Tax Reimbursement Senior Freeze Program. Revenue Growth Expected to Moderate for Fiscal Year 2023 as Economic Concerns Loom. Veterans or surviving spouses need to apply at their municipal tax office.

Those over the age of 65 may also qualify for additional property tax exemption programs. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. Other Property Tax Benefits Administered by the local municipality Last Updated.

Your municipal tax assessor or collector. Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled. Resident tax return etc.

2020 veteran applicants for the 100 Disabled Veteran Property Tax Exemption were no longer required to have served in specific geographic locationsconflict zones but were still required to have served during a. The maximum exemption amount allowed by the state is 40000. More veterans can get.

Treasury Announces NJ Division of Taxation Extends Filing Payment Deadlines for Tropical Storm Ida Victims. Military Personnel Veterans New for 2021 - Income Tax. More than 57000 veterans will soon be eligible for help paying their property taxes after New Jersey voters on.

It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. New limitations on Urban Enterprise Zone Exemption Certificates. The exemption amount varies as each town votes on the amount.

To file an application by phone1-877-658-2972. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million. RESIDENCY - New Jersey drivers license or motor vehicle registration voters registration NJ.

CuraDebt is a company that provides debt relief from Hollywood Florida. 250 Veterans Property Tax Deduction Effective December 4 2020 State law PL. More veterans can get help with property taxes New Jersey voters say.

If an eligible veteran has died their surviving spouse can collect the tax relief benefits. If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability by. NJ Property Tax Relief Programs.

820 Mercer Street Cherry Hill NJ 08002 Phone. The state of New Jersey provides several veteran benefits. Veteran Tax Deduction Application PDF Forms.

About the Company Nj Property Tax Relief For Veterans. Property Tax Relief Forms. Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption.

The program was restored in the approved budget that went into effect on October 1 2020. CuraDebt is a debt relief company from Hollywood Florida. What do I need to do.

The law also exempts service people from paying New Jersey Income Tax on their wages if they are being. The main reasons behind the steep rates are high property values and education costs.

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Bergen Pushes For Proportional Property Tax Exemption For Disabled Veterans Nj Assembly Republicans

100 Disabled Veteran Housing Allowance Hill Ponton P A

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

If You Are Buying Or Selling Real Estate You May Be Eligible For A Heroes Rebate Teachers Police Fire Fighters Military Veter Teachers Military Veterans Hero

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

How You Can Buy A Home In New Zealand Even If You Aren T A Resident Home Buying Luxury Condo Condo

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Nj Property Tax Relief Program Updates Access Wealth

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Veteran Tax Exemptions By State

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com